Are you ready to dive into a world of waves? An exciting and fun-filled water adventure? We are here to guide you to the perfect solution for thrilling water escapades. Boat finance is not a daunting task anymore! Here’s the step-by-step guide to getting easy boat loans in Australia.

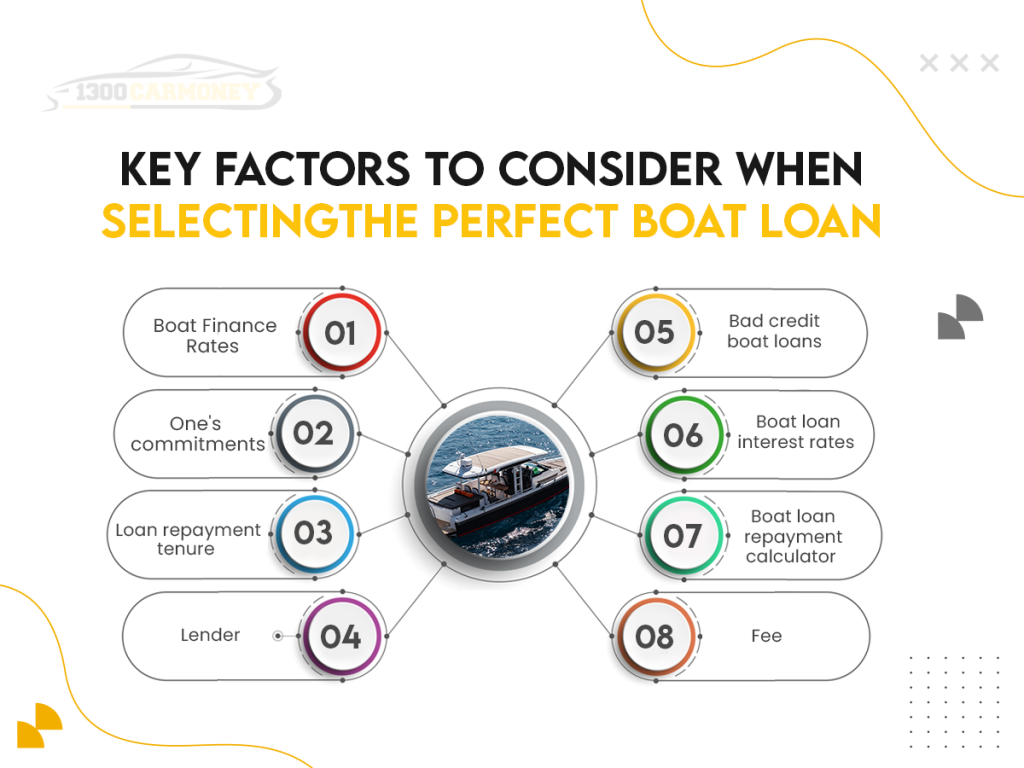

Some Factors to Help You Choose the Right Boat Loan

It is very important to do a detailed investigation before locking in a particular boat loan. Here are the main things to consider:

Boat finance rates

Before you decide to use a boat loan, deciding the loan amount you want to borrow is important. Next, calculate the monthly payment liability based on the loan amount and the loan tenure. Comparing loans offered by different lenders will help you choose a more affordable boat loan.

One’s commitments

Before applying for a loan, consider existing debts and obligations. Sometimes, one may already have outstanding loans to repay or credit card bills to settle. It is important to consider these liabilities and calculate one’s debt-to-income ratio.

Lender

We receive constant calls and text messages offering us personal loans at attractive prices and terms. With so many options, choosing the right lender can be overwhelming. It is important to do due diligence to avoid scammers and loan traps. The best option to make an informed decision is to use an online platform. One can compare different lenders, their terms, and interest rates. Further, on such platforms, one will receive notifications from time to time about the offers of these different lenders. If you are looking for a long-term loan, you can choose an established bank offering favorable terms.

Loan repayment tenure

When taking a loan, it is recommended to repay it as soon as possible. Defaulting on loan repayments can leave a bad impression on your credit history. This may prevent lenders from approving you for a loan in the future. So it’s important to assess your repayment options and choose the right loan term for you while you plan to pay back soon.

Bad credit boat loans

A credit score is the main indicator of one’s eligibility for a boat loan. Although a good score enhances the chances of getting approved for a boat loan, the credit score also affects the approved loan amount. It is essential to check your credit history before taking out a boat loan. A credit score above 750 is a good score for getting a boat loan with favorable conditions. A credit score reflects your overall financial health and gives lenders a better idea of your ability to repay your debt.

Boat loan interest rates

There are potentially countless lenders who approach with impressive and slightly lower interest rates. While it may be enticing, keep in mind that choosing a loan with such a low-interest rate could end up paying more due to many other unfair loan terms. Another factor to keep in mind is the interest rate calculation. Usually, loan interest calculated according to the balance sheet method is considered ideal.

Fee

Some lenders charge a fee for boat loans. The origination fee is a fixed amount that should be paid when the loan application is sent, or the loan application is approved. Knowing these fee rates charged by different lenders will help one make the right decision and avoid unnecessary fees.

Boat loan repayment calculator

Before you start applying for a boat loan, it is important to do research. This calculator helps one to know how much one can borrow. How much will one’s loan repayments be? How can one repay one’s loan sooner? Knowing this will help you understand your options for repaying the loan on time.

Tips on Getting a Boat Loan Approved

Here are some tips to help you complete that financial application and get approved.

Prepare to answer

One must first need to be honest when talking to a lender about one’s loan application. The answers will decide how much they will allow one to borrow, the interest rates that apply, and the repayment period. The process will go much more smoothly if one is prepared in advance to answer these questions: if one has a house? How long has one lived at one’s current address? Has one ever filed for bankruptcy? How long has one worked in one’s current job? Does one have a credit card? What is one’s current income? What is one’s net worth?

Give lenders more guarantees

While one applies for a boat loan, the lender will check one’s ability to repay the loan. So, one must submit documents about one’s job, fixed income, and bank savings and investments. For example a secured boat loan will also require a security. However, to give the lender more certainty, one should declare any other assets one owns. These things can increase one’s chances of getting approved for a boat loan, but they also give lenders more reason to offer one the perfect interest rate.

Get pre-approved

One of the best things to do before buying a boat is to get pre-approved. This document from the lender will guarantee a certain loan amount on completing one’s application. 1300Carmoney has a free online boat loan calculator in Australia to help determine what and how much one needs to buy a new boat. When one gets pre-approved for a boat loan, one can buy the boat of one’s dreams because one is guaranteed to have the money to buy it. This can give one the confidence to negotiate. Pre-approval gives one the opportunity to prepare one’s budget and ensure one doesn’t overspend when buying a boat. Finally, pre-approval can speed up the actual boat loan application. This will greatly reduce the processing time to get approved and purchase the boat one needs. Learn about other financial pre-approval benefits.

Consider operating costs

No matter what type of boat one plans to buy, it’s always important to consider the cost of maintaining it. Small boats are not expensive financially and are also easier to handle while larger cruisers can save money — from mooring to engine maintenance—and a lot of fuel for those who like to travel. Therefore, when signing a loan application, one should carefully consider what kind of boat one wants to buy. In addition to the actual price, running costs require a significant investment, it can affect one’s financial options for years to come.

It makes sense to finance one’s boat

One of the main reasons people get boat financing is because it’s easier to get and do. Some marine lenders offer competitive rates, quick decisions, and trade-in offers. Many will even allow you to add boat accessories to the loan amount. Enquire about all these points before choosing. Taking out a boat loan allows you to keep the cash and, in some cases, even deduct the interest on the boat loan.

Choose a new or used boat

When applying for a boat loan, getting a new or near-new but used boat will improve one’s chances of approval. Lenders are more likely to sign a loan approval if they know one wants to buy a new boat. They may even offer lower interest rates than usual. If one decides to go with a used boat, ensure it is no more than five years old so one has a better chance of being approved.

Compare the best boat loans

Try not to choose the lender close by. Shopping around and comparing boat loans is important to find the best deal for one’s needs. Today, many institutions in Australia offer loan services. Each offers a variety of ideal boat loan products to suit one’s needs. However, one should avoid credit files from different lenders multiple times in a short time, as this can look suspicious. It would help if one also looked at the overall picture. Avoid being tempted by the attractive rates offered by some lenders, but there are a few factors to consider while choosing a boat financing source. Things like how long one plan to keep the boat, terms and prepayment penalties, etc.

Choose A Reliable Financier for Boat Loans in Australia

With your fun and adventure goals in mind, look at a lender’s creditworthiness and quality of customer service before applying for a boat loan. Although there are many boat loans, choosing the right one requires careful research on the borrower’s part. Before applying for a loan, analyse all the pros and cons of different lenders, carefully read the loan documents and sign those that offer a flexible repayment options, competitive interest rate, and an appropriate term. We offer you the best boat loan you need to buy the boat of your dreams. Getting the help of a professional loan company like 1300Carmoney is essential to get flexible ship finance products. To learn more, you can visit 1300Carmoney website rightaway! If you would like to apply for pre-approval online, you can do so here.