Do you want to experience the pleasure of owning a car and driving in style without draining your bank account? Read through this blog and get started with quick and easy car finance approvals and drive your dream car home in no time.

Looking for a Car Loan?

If you are deciding to purchase a new or used car, then read through these strategies

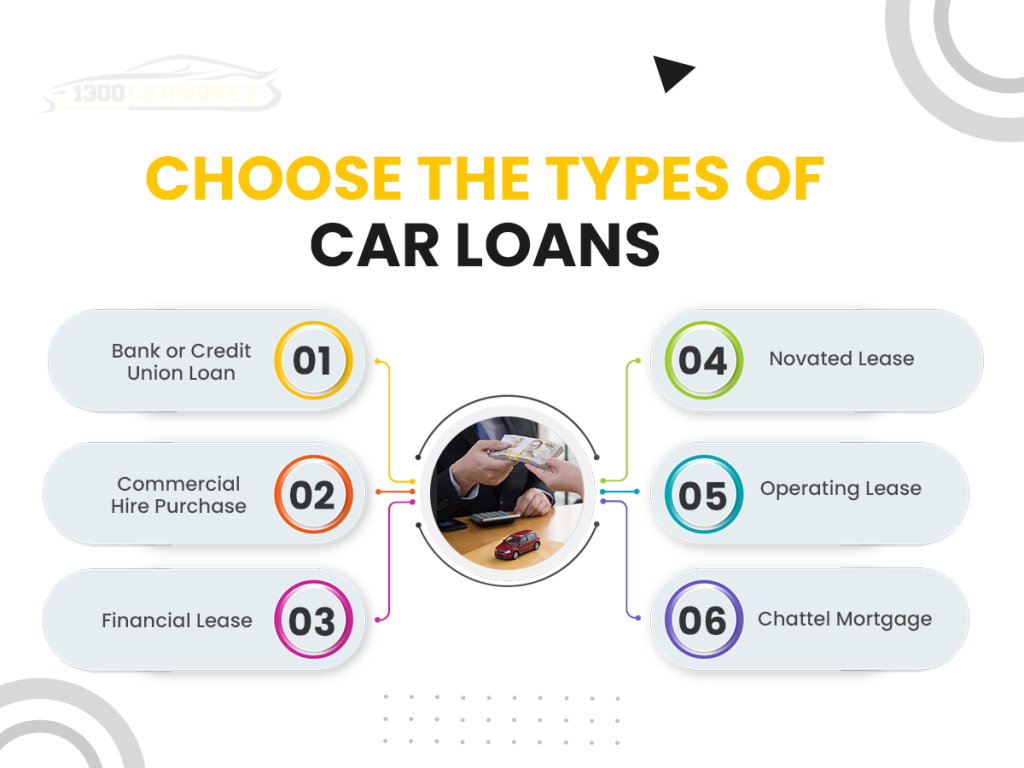

Choose the Type of Car Loans

There is a wide range of car loan options that meet your specific needs. It is also an appropriate idea to use car loan calculators before taking further steps. Here are some of the types of loans you can opt for

Bank or Credit Union Loan

One needs to be financially sound and well-prepared for extra expenditures. In this loan, the lender lends the client the fund to purchase a new or a used car. This loan can be secured or unsecured. Vehicles are to be fully insured as they will be considered the security for standard loans.

Commercial Hire Purchase

This loan can be for individuals and businesses. The lender buys the car and then hires it to the customer for a set time. The car is transferred to the customer when the entire payment is done.

Financial Lease

The lender purchases the car and then leases it to the customer. This provides the immediate utilization of the car with no capital outlay or a little capital outlay. The financial lease is available for businesses and individuals if your car is for business purposes. In the final stage, the consumer can refinance, sell, return, or purchase the vehicle for the residual amount.

Novated Lease

From the lender, the employee leases the four-wheeler. The consumer covers the operational costs such as registration, servicing, insurance, and tires. The employer is responsible for paying the lender through a novated deed on the employee’s salary.

Operating Lease

The lender retains ownership of the car. An operating lease is an agreement where the lender purchases the car and rents it to the consumer. The consumer has no risks associated with ownership, adding the residual at the end of the period. At the end of the loan term, the consumer can purchase the car or continue to rent or change to a newer car.

Chattel Mortgage

A fixed loan is where the lender upfronts fund to purchase a car. The lender holds a mortgage over the car used as security for the finance. A residual payment can also be placed at the end of the loan term. The consumer finances the total purchase rate of the car and can make an advance deposit or can use a trade-in.

Discover the Loan Product That Best Suits You

Once you decide on the type of loan, comparing loans would be the next step. Thoroughly discover the market.

Car Loan Interest Rates

The interest rate one will pay is normally the most significant factor in deciding the overall expense of the loan. Fixing a budget on what one can afford in monthly repayments and for the period can be crucial in ensuring that one doesn’t overextend the loan term. Remember, the expense of a car loan includes paying off not alone the cost of the car but the fees and the interest too.

Best Car Loan Rates

A few loans are flexible when it comes to added payments. One can use a car loan repayment calculator to select the most suitable loan product. By using this strategy, you can get a lower car loan rate too.

Submit the Application

When one applies for a car loan, the financier will scrutinize your capacity to repay the loan. The lender examines one’s monthly expenses, debt obligations, and salary.

Tips for Getting the Approval

Here are some pointers on improving one’s chances of getting car loans in Australia.

Bad Credit Loans

Whether you are self-employed or working for a company, financiers will examine the credit score of any applicant. A good credit score can give way for easy car loans.

A Secured Car Loan

If one owns a valuable asset, financiers may offer equity releases on the existing home. This can profit one by allowing him to buy a car when his financial situation is unmanageable.

Keep the Business Record Intact

Updating and keeping your business records organized can help you collect proof of your salary while applying for a car loan.

Maintain Accuracy

Accurate information on your loan application regarding income, employment history, and expenditures is key to getting a successful car loan.

Choose a Shorter Loan Term

A shorter loan term will have lower interest rates and result in paying less interest on a whole.

Make a Deposit

The amount of funds borrowed gets reduced when you make a deposit. This also adds to the chances of getting a car loan easily.

Note: The deposit one makes must be a minimum of ten percent of the car’s cost.

Get the Best Car Loans from 1300Carmoney

Securing a loan for a car purchase can be a daunting process. With the tools like car loan calculator Australia, the right preparation, and information, car loan finance can be processed without any hassles. Check your credit score, research various lenders, have a stable income and residential history, and find a suitable co-signer. An expert team like 1300Carmoney can enhance your loan approval chances. Choosing 1300Carmoney can save time, reduce stress, and you can get relaxed as we guide you to make informed decisions. So, choose the right car loan and reap the benefits.