What is a Car Loan?

Not all of us can afford to buy a four-wheeler. That is why you must choose car loans with the best interest rates. You can’t buy cars with your money altogether, and so you would require external support who would do financing. We have financing firms to help you financially and lend money at the most needed hours. You can repay with interest for an agreed time, generally through monthly installments.

Car finance can be either secured or unsecured. In a secured vehicle loan agreement, your car is used as security for the loan. The loaner has every right to repossess or sell the car if he fails to make the repayments negotiated by pledging it as collateral. In contrast, an unsecured car finance set-up doesn’t need you to pledge your vehicle as collateral. A drawback is the loaner may not get his money back. So, your car finance has a higher interest rate to manage the high risk.

Types of Car Loans

There are different types of a car loan

- Chattel Mortgage is a loan for cars or any other movable object like a yacht or a boat that will be utilized specially for business purposes. The loaner grants the loanee the money to purchase a commercial vehicle and places a debenture over the vehicle as security against the loans.

- Novated Lease is a finance set-up used with the salary package. This means your employer pays for your vehicle and its running costs out of your salary through a combo of pre-tax and post-tax salary debits.

- Personal Car Loan: This is a kind of personal loan that you take out to purchase a car. It can be secured or unsecured. Most loanees use their car as security for the loan to get a lower interest rate. Unlike other car loan options, you don’t need to use your vehicle for a particular purpose.

- Finance Lease: Available for businesses and individuals, this option includes the lender purchasing the car and leasing it to you as the loanee. You can use the car immediately with little or no capital expenses in return for monthly rental payments. Car maintenance is your responsibility. Towards the end of the lease period, you can either return, recapitalize or purchase the car for its residual amount.

- Operating Lease: It is similar to the finance lease, where the loaner buys the vehicle and then rents it to the loanee. However, the loaner retains ownership of the car and is responsible for its maintenance. There are no risks associated with ownership or no residual liability. At the end of the term, you may opt to continue renting your car, purchase it or change to a newer model.

Getting Your Car Loans Approved

Getting car loans approved in advance before shopping for new cars is essential. A pre-approval is conditional approval from a loaner. A document states the money the loaner will lend you and the estimated interest rate with loan terms. You can utilise this for car shopping and budget reference before buying cars.

Getting pre-approval can help you for three main reasons:

- You will get an idea of the amount required to borrow,

- You will have excellent negotiating power

- You can channelize the car that suits your budget

Size of Down Payment

The sum of money you offer as a down payment for your loan can bring down your loan amount—a sizable down payment results in less risk for the loaner. As a result, the lender will provide you with a car loan with more favorable terms.

Age of Vehicle

Since a new car has a higher resale value, taking out a car loan to purchase a new one has a lesser interest rate than buying a used one. In case of repossession, a loaner can sell the car for a much higher rate to recover the losses.

Credit Scores

Your credit scores greatly impact your loan. A loaner will check your credit history and rating to understand how you manage your dues before getting your pre-approved loan. The higher the credit score, the higher your possibility of getting approved for a car loan. In addition, a credit score helps get better loan terms and low-interest rates. Conversely, your credit score will be low if you have a history of doing late payments, loan defaults, maxing out credit cards, or bankruptcy. Your car loan will likely get rejected if you have a poor credit score.

Debt to Income Ratio

It is the measure of the overall debt in comparison to your income over a particular period. Loaners utilize this to assess your capacity for repayment on new dues. So, for example, if one has a high income and DTI, a loaner may only provide a lower loan amount.

Length of Loan

The net cost of your loan is affected by the time length one will be making the repayments. The number of years you take to repay your loan, the longer the loaner will wait to get the amount back. Hence they offer rewards to the loanees who take a shorter term with a minimized interest rate.

Comparing Interest Rates

It is vital to shop for car loans to compare interest rates that best suit your budget. Understanding the average interest rate the loaners are charging can put you in a stronger position to negotiate and get the best deal. So, a car loan with great terms and lower interest rates can save you money significantly. You can use an online car loan calculator in Australia to compare car loan interest rates. Apart from offering a quick calculation, it helps estimate your borrowing costs appropriately.

Best Car Loan Company in Australia

Owning a car is every Australian citizen’s dream. Whether sedan or sports car, owning a car is on every person’s wishlist. Generally, everyone considers it an expensive affair, but it is not with 1300Carmoney. Almost every leading Australian loan company provides car loans at affordable interest rates. But, if you are searching for the best car loan rates, look no further when we are here. Our car loan payment calculator makes it easy to meet your financial requirements.

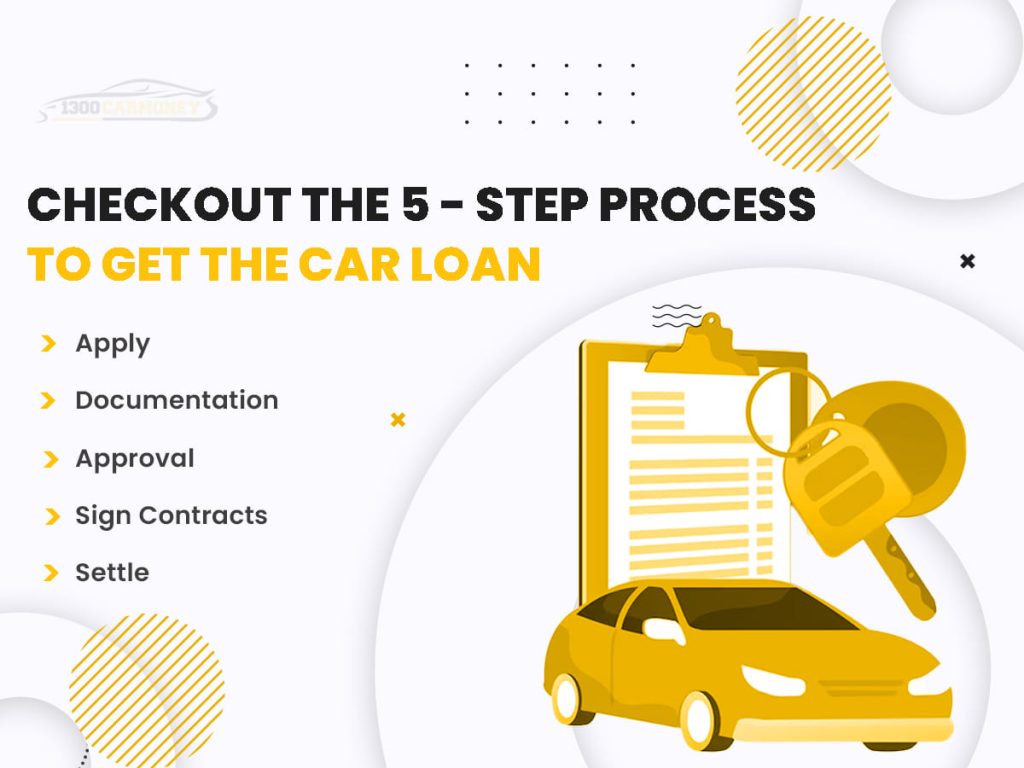

Our Five-Step Process To Get The Car Loan

You have to walk five quick steps to get a car loan from 1300Carmoney. This is how we work:

- Apply

You can either call us or apply online to complete your application. First, you have to tell us how much you want to borrow.

- Documentation

Checking your documents and streamlining your application process will take just ten minutes.

- Approval

Once your application is approved, we will notify you, and you can review and accept the contract online.

- Sign Contracts

You can sign up electronically with our online availability.

- Settle

The loan money will reach your account the next day it is approved. So, get the best car loans in Australia with low-interest rates at 1300Carmoney.

Key Takeaways

Spending a sizable sum of money on cars is an excellent investment. Hence thoughtful money management is necessary. Always compare car loans and car loan interest rates to get hold of the best car loan finance. Interest rates may vary between 4.09 to 12.09%. Further, you won’t get car loans with bad credit. Hence you must maintain a good credit history. So, before applying for car loans, please remember the points discussed in the blog and find the best car loans in Australia.